Do You Have To Pay Sales Tax On A Used Car In Michigan . short answer michigan sales tax on used cars: Here are your best options. short answer michigan car sales tax: under michigan law, the use tax payable on a used vehicle transfer is 6% on the greater of the purchase price or the. Sales tax is usually applied to both new and used car purchases, but specific. short answer michigan sales tax on vehicles: Michigan imposes a 6% state sales tax on the purchase price of. do i have to pay sales tax on a used car purchase? The sales tax is the same 6% on a used vehicle. Michigan imposes a 6% state sales tax on the purchase price of. For example, if you were to purchase a used car for $15,000, then you will have to pay an additional $900 in sales tax. do i have to pay sales tax on a used car? Michigan imposes a 6% state sales tax on the purchase price of all. there are a few ways that you can legally get out of paying sales tax on your new used car.

from bestlettertemplate.com

Here are your best options. short answer michigan car sales tax: do i have to pay sales tax on a used car purchase? short answer michigan sales tax on used cars: there are a few ways that you can legally get out of paying sales tax on your new used car. Michigan imposes a 6% state sales tax on the purchase price of. Michigan imposes a 6% state sales tax on the purchase price of. under michigan law, the use tax payable on a used vehicle transfer is 6% on the greater of the purchase price or the. For example, if you were to purchase a used car for $15,000, then you will have to pay an additional $900 in sales tax. The sales tax is the same 6% on a used vehicle.

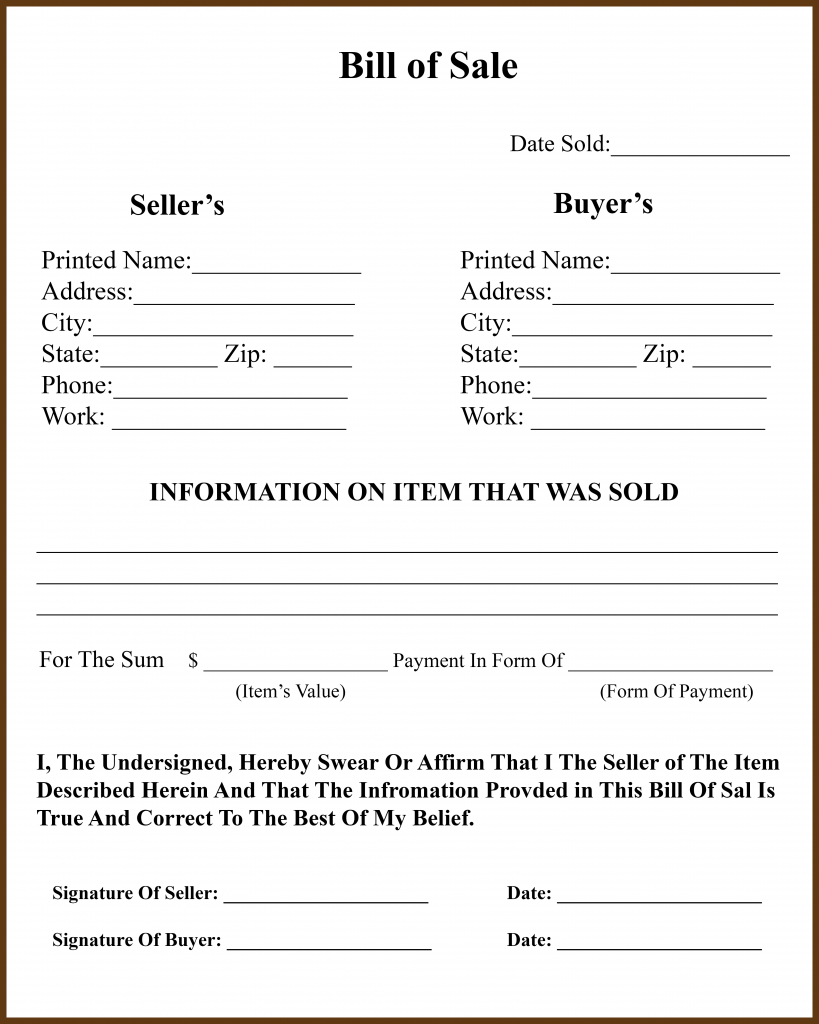

Michigan Bill of Sale Form for DMV, Car, Boat PDF & Word

Do You Have To Pay Sales Tax On A Used Car In Michigan Sales tax is usually applied to both new and used car purchases, but specific. short answer michigan car sales tax: do i have to pay sales tax on a used car? Michigan imposes a 6% state sales tax on the purchase price of. Michigan imposes a 6% state sales tax on the purchase price of all. For example, if you were to purchase a used car for $15,000, then you will have to pay an additional $900 in sales tax. Michigan imposes a 6% state sales tax on the purchase price of. short answer michigan sales tax on vehicles: short answer michigan sales tax on used cars: The sales tax is the same 6% on a used vehicle. Here are your best options. Sales tax is usually applied to both new and used car purchases, but specific. there are a few ways that you can legally get out of paying sales tax on your new used car. do i have to pay sales tax on a used car purchase? under michigan law, the use tax payable on a used vehicle transfer is 6% on the greater of the purchase price or the.

From www.self.inc

5 Ways to Pay Off Your Car Loan Faster Self. Credit Builder. Do You Have To Pay Sales Tax On A Used Car In Michigan Michigan imposes a 6% state sales tax on the purchase price of. Michigan imposes a 6% state sales tax on the purchase price of all. The sales tax is the same 6% on a used vehicle. short answer michigan sales tax on vehicles: do i have to pay sales tax on a used car? For example, if you. Do You Have To Pay Sales Tax On A Used Car In Michigan.

From www.flickr.com

get car history check free in uk Purchasing an used car mi… Flickr Do You Have To Pay Sales Tax On A Used Car In Michigan under michigan law, the use tax payable on a used vehicle transfer is 6% on the greater of the purchase price or the. Michigan imposes a 6% state sales tax on the purchase price of. Michigan imposes a 6% state sales tax on the purchase price of. short answer michigan sales tax on vehicles: short answer michigan. Do You Have To Pay Sales Tax On A Used Car In Michigan.

From www.carsalerental.com

Arizona Sales Tax Used Car Private Party Car Sale and Rentals Do You Have To Pay Sales Tax On A Used Car In Michigan The sales tax is the same 6% on a used vehicle. short answer michigan sales tax on used cars: Michigan imposes a 6% state sales tax on the purchase price of. Here are your best options. there are a few ways that you can legally get out of paying sales tax on your new used car. short. Do You Have To Pay Sales Tax On A Used Car In Michigan.

From conduitnews.com

Where Are We Now? Used Car Sales Tax Conduit News Arkansas Do You Have To Pay Sales Tax On A Used Car In Michigan For example, if you were to purchase a used car for $15,000, then you will have to pay an additional $900 in sales tax. Sales tax is usually applied to both new and used car purchases, but specific. The sales tax is the same 6% on a used vehicle. Michigan imposes a 6% state sales tax on the purchase price. Do You Have To Pay Sales Tax On A Used Car In Michigan.

From www.newarkadvocate.com

States with the highest and lowest sales taxes Do You Have To Pay Sales Tax On A Used Car In Michigan Michigan imposes a 6% state sales tax on the purchase price of. Sales tax is usually applied to both new and used car purchases, but specific. For example, if you were to purchase a used car for $15,000, then you will have to pay an additional $900 in sales tax. under michigan law, the use tax payable on a. Do You Have To Pay Sales Tax On A Used Car In Michigan.

From bonglovelace.blogspot.com

Bong Lovelace Do You Have To Pay Sales Tax On A Used Car In Michigan For example, if you were to purchase a used car for $15,000, then you will have to pay an additional $900 in sales tax. Michigan imposes a 6% state sales tax on the purchase price of. short answer michigan sales tax on used cars: do i have to pay sales tax on a used car? short answer. Do You Have To Pay Sales Tax On A Used Car In Michigan.

From taxsaversonline.com

Do You Have to Pay Sales Tax on Used Car? Do You Have To Pay Sales Tax On A Used Car In Michigan short answer michigan car sales tax: Michigan imposes a 6% state sales tax on the purchase price of. do i have to pay sales tax on a used car? short answer michigan sales tax on vehicles: Michigan imposes a 6% state sales tax on the purchase price of all. For example, if you were to purchase a. Do You Have To Pay Sales Tax On A Used Car In Michigan.

From www.myxxgirl.com

Bill Of Sale Form Minnesota Motor Vehicle Bill Of Sale Templates My Do You Have To Pay Sales Tax On A Used Car In Michigan do i have to pay sales tax on a used car? Sales tax is usually applied to both new and used car purchases, but specific. do i have to pay sales tax on a used car purchase? The sales tax is the same 6% on a used vehicle. short answer michigan sales tax on vehicles: Michigan imposes. Do You Have To Pay Sales Tax On A Used Car In Michigan.

From formzoid.com

Free Fillable Michigan Bill of Sale Form ⇒ PDF Templates Do You Have To Pay Sales Tax On A Used Car In Michigan short answer michigan sales tax on used cars: under michigan law, the use tax payable on a used vehicle transfer is 6% on the greater of the purchase price or the. Sales tax is usually applied to both new and used car purchases, but specific. For example, if you were to purchase a used car for $15,000, then. Do You Have To Pay Sales Tax On A Used Car In Michigan.

From exornsgyz.blob.core.windows.net

Sales Tax On Used Cars In New Brunswick at Roger Oyer blog Do You Have To Pay Sales Tax On A Used Car In Michigan Sales tax is usually applied to both new and used car purchases, but specific. The sales tax is the same 6% on a used vehicle. Michigan imposes a 6% state sales tax on the purchase price of. do i have to pay sales tax on a used car? Michigan imposes a 6% state sales tax on the purchase price. Do You Have To Pay Sales Tax On A Used Car In Michigan.

From publiccarauctionscalifornia.com

Sales Tax on Used Cars in California Auto Auctions California Do You Have To Pay Sales Tax On A Used Car In Michigan Here are your best options. do i have to pay sales tax on a used car purchase? short answer michigan sales tax on vehicles: short answer michigan sales tax on used cars: do i have to pay sales tax on a used car? Michigan imposes a 6% state sales tax on the purchase price of. . Do You Have To Pay Sales Tax On A Used Car In Michigan.

From www.patriotsoftware.com

How to Pay Sales Tax for Small Business Guide + Chart Do You Have To Pay Sales Tax On A Used Car In Michigan The sales tax is the same 6% on a used vehicle. For example, if you were to purchase a used car for $15,000, then you will have to pay an additional $900 in sales tax. under michigan law, the use tax payable on a used vehicle transfer is 6% on the greater of the purchase price or the. Here. Do You Have To Pay Sales Tax On A Used Car In Michigan.

From privateauto.com

How Much are Used Car Sales Taxes in Kentucky? Do You Have To Pay Sales Tax On A Used Car In Michigan Michigan imposes a 6% state sales tax on the purchase price of. The sales tax is the same 6% on a used vehicle. short answer michigan sales tax on vehicles: under michigan law, the use tax payable on a used vehicle transfer is 6% on the greater of the purchase price or the. short answer michigan sales. Do You Have To Pay Sales Tax On A Used Car In Michigan.

From mungfali.com

Us Tax Revenue By Year Chart Do You Have To Pay Sales Tax On A Used Car In Michigan For example, if you were to purchase a used car for $15,000, then you will have to pay an additional $900 in sales tax. do i have to pay sales tax on a used car? Michigan imposes a 6% state sales tax on the purchase price of. The sales tax is the same 6% on a used vehicle. . Do You Have To Pay Sales Tax On A Used Car In Michigan.

From www.carsalerental.com

When Do I Pay Sales Tax On A New Car Car Sale and Rentals Do You Have To Pay Sales Tax On A Used Car In Michigan do i have to pay sales tax on a used car? For example, if you were to purchase a used car for $15,000, then you will have to pay an additional $900 in sales tax. short answer michigan sales tax on used cars: Michigan imposes a 6% state sales tax on the purchase price of. do i. Do You Have To Pay Sales Tax On A Used Car In Michigan.

From paymentpoin.blogspot.com

How To Delete A Tax Payment In Quickbooks Online Payment Poin Do You Have To Pay Sales Tax On A Used Car In Michigan For example, if you were to purchase a used car for $15,000, then you will have to pay an additional $900 in sales tax. Michigan imposes a 6% state sales tax on the purchase price of all. Here are your best options. there are a few ways that you can legally get out of paying sales tax on your. Do You Have To Pay Sales Tax On A Used Car In Michigan.

From tramiteseeuu.com

Texas “Sales & Use Tax Permit” y el “Resale Certificate” Todo lo que Do You Have To Pay Sales Tax On A Used Car In Michigan Michigan imposes a 6% state sales tax on the purchase price of. there are a few ways that you can legally get out of paying sales tax on your new used car. under michigan law, the use tax payable on a used vehicle transfer is 6% on the greater of the purchase price or the. Sales tax is. Do You Have To Pay Sales Tax On A Used Car In Michigan.

From peisnerjohnson.com

What Is the Sales Tax in Michigan? Peisner Johnson Do You Have To Pay Sales Tax On A Used Car In Michigan Michigan imposes a 6% state sales tax on the purchase price of all. short answer michigan sales tax on used cars: under michigan law, the use tax payable on a used vehicle transfer is 6% on the greater of the purchase price or the. do i have to pay sales tax on a used car purchase? Michigan. Do You Have To Pay Sales Tax On A Used Car In Michigan.